Short Put Calendar Spread

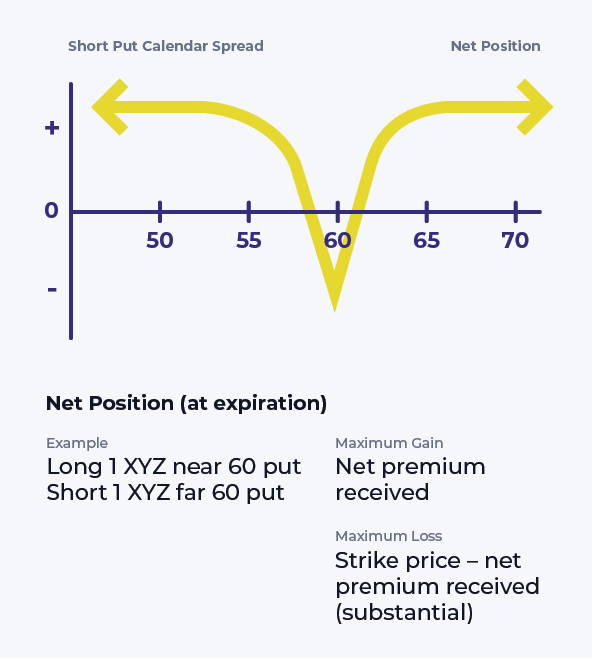

Short Put Calendar Spread - A short put spread, or bull put spread, is an advanced vertical spread strategy with an obligation to buy and a right to sell at two different strike prices. Buying one put option and selling a second put option with a more distant expiration is an example of a short put calendar spread. Die kalender spread strategie besteht aus dem leerverkauf einer put option und dem kauf einer put option mit demselben basispreis. To profit from a large stock price move away from the strike price of the calendar spread with limited risk if there is little or no price change.

Short Put Calendar Short put calendar Spread Reverse Calendar

Buying one put option and selling a second put option with a more distant expiration is an example of a short put calendar spread. A short put spread, or bull put spread, is an advanced vertical spread strategy with an obligation to buy and a right to sell at two different strike prices. Die kalender spread strategie besteht aus dem.

Short Put Calendar Spread

Buying one put option and selling a second put option with a more distant expiration is an example of a short put calendar spread. To profit from a large stock price move away from the strike price of the calendar spread with limited risk if there is little or no price change. Die kalender spread strategie besteht aus dem leerverkauf.

Advanced options strategies (Level 3) Robinhood

To profit from a large stock price move away from the strike price of the calendar spread with limited risk if there is little or no price change. Buying one put option and selling a second put option with a more distant expiration is an example of a short put calendar spread. Die kalender spread strategie besteht aus dem leerverkauf.

Short Put Calendar Spread Option Samurai Blog

Die kalender spread strategie besteht aus dem leerverkauf einer put option und dem kauf einer put option mit demselben basispreis. To profit from a large stock price move away from the strike price of the calendar spread with limited risk if there is little or no price change. Buying one put option and selling a second put option with a.

Short Put Calendar Spread Printable Calendars AT A GLANCE

A short put spread, or bull put spread, is an advanced vertical spread strategy with an obligation to buy and a right to sell at two different strike prices. Buying one put option and selling a second put option with a more distant expiration is an example of a short put calendar spread. To profit from a large stock price.

Calendar Put Spread Options Edge

To profit from a large stock price move away from the strike price of the calendar spread with limited risk if there is little or no price change. Die kalender spread strategie besteht aus dem leerverkauf einer put option und dem kauf einer put option mit demselben basispreis. Buying one put option and selling a second put option with a.

Put Calendar Spread Guide [Setup, Entry, Adjustments, Exit]

To profit from a large stock price move away from the strike price of the calendar spread with limited risk if there is little or no price change. Die kalender spread strategie besteht aus dem leerverkauf einer put option und dem kauf einer put option mit demselben basispreis. A short put spread, or bull put spread, is an advanced vertical.

Trading Guide on Calendar Call Spread AALAP

Die kalender spread strategie besteht aus dem leerverkauf einer put option und dem kauf einer put option mit demselben basispreis. To profit from a large stock price move away from the strike price of the calendar spread with limited risk if there is little or no price change. A short put spread, or bull put spread, is an advanced vertical.

Short Put Calendar Spread Options Strategy

A short put spread, or bull put spread, is an advanced vertical spread strategy with an obligation to buy and a right to sell at two different strike prices. Buying one put option and selling a second put option with a more distant expiration is an example of a short put calendar spread. To profit from a large stock price.

Put Calendar Spread Guide [Setup, Entry, Adjustments, Exit]

To profit from a large stock price move away from the strike price of the calendar spread with limited risk if there is little or no price change. A short put spread, or bull put spread, is an advanced vertical spread strategy with an obligation to buy and a right to sell at two different strike prices. Die kalender spread.

Die kalender spread strategie besteht aus dem leerverkauf einer put option und dem kauf einer put option mit demselben basispreis. Buying one put option and selling a second put option with a more distant expiration is an example of a short put calendar spread. A short put spread, or bull put spread, is an advanced vertical spread strategy with an obligation to buy and a right to sell at two different strike prices. To profit from a large stock price move away from the strike price of the calendar spread with limited risk if there is little or no price change.

Die Kalender Spread Strategie Besteht Aus Dem Leerverkauf Einer Put Option Und Dem Kauf Einer Put Option Mit Demselben Basispreis.

Buying one put option and selling a second put option with a more distant expiration is an example of a short put calendar spread. A short put spread, or bull put spread, is an advanced vertical spread strategy with an obligation to buy and a right to sell at two different strike prices. To profit from a large stock price move away from the strike price of the calendar spread with limited risk if there is little or no price change.

![Put Calendar Spread Guide [Setup, Entry, Adjustments, Exit]](https://i2.wp.com/assets-global.website-files.com/5fba23eb8789c3c7fcfb5f31/607da29411b814023198cd31_Put-Calendar-Spread-Options-Strategies-Option-Alpha-Handbook.png)

![Put Calendar Spread Guide [Setup, Entry, Adjustments, Exit]](https://i2.wp.com/assets-global.website-files.com/5fba23eb8789c3c7fcfb5f31/6019b83133ac2d32ef084fa5_TsbQgZxQ0e-zKJ9h6Fa7azNlnvn0zH-UBlX3l7hriHll2es1fvyFY5N-nOyM1153MJ4wXLNIhH4zanFkJQB0mpqs81lwEBIvqa7IZQRPWXZY1i3J7vV3BpTIL3v5nCyqn-CEbq2U.png)