Put Calendar Spread

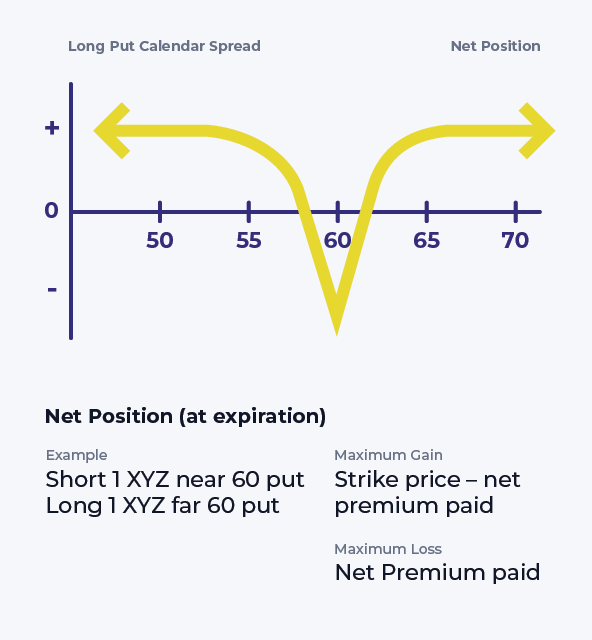

Put Calendar Spread - To profit from a directional stock price move to the strike price of the calendar spread with limited risk if the market goes in the other direction. A calendar spread is a long volatility trade so tends to benefit from rising volatility after the trade is placed. When running a calendar spread with puts, you’re selling and buying a put with the same strike price, but the put you buy will have a later expiration date than the put you sell. Die kalender spread strategie besteht aus dem leerverkauf einer put option und dem kauf einer put option mit demselben basispreis. A long calendar spread with puts is created by. This helps reduce the risk of early assignment. The complex options trading strategy, known as the put calendar spread, is a type of calendar spread that seizes opportunities from time. Das verfallsdatum der verkauften put option ist näher als das verfallsdatum der gekauften put option. They are most profitable when the. Calendar spreads allow traders to construct a trade that minimizes the effects of time.

Calendar Spread Options Trading Strategy In Python

The complex options trading strategy, known as the put calendar spread, is a type of calendar spread that seizes opportunities from time. Calendar spreads allow traders to construct a trade that minimizes the effects of time. Die kalender spread strategie besteht aus dem leerverkauf einer put option und dem kauf einer put option mit demselben basispreis. A calendar spread is.

Credit Spread Options Strategies (Visuals and Examples) projectfinance

When running a calendar spread with puts, you’re selling and buying a put with the same strike price, but the put you buy will have a later expiration date than the put you sell. The complex options trading strategy, known as the put calendar spread, is a type of calendar spread that seizes opportunities from time. Das verfallsdatum der verkauften.

Options Trading PCS (Put Calendar Spread) YouTube

A long calendar spread with puts is created by. The complex options trading strategy, known as the put calendar spread, is a type of calendar spread that seizes opportunities from time. Calendar spreads allow traders to construct a trade that minimizes the effects of time. A calendar spread is a long volatility trade so tends to benefit from rising volatility.

Long Put Calendar Spread (Put Horizontal) Options Strategy

Das verfallsdatum der verkauften put option ist näher als das verfallsdatum der gekauften put option. The complex options trading strategy, known as the put calendar spread, is a type of calendar spread that seizes opportunities from time. Generally if trading a bullish spread i would use calls and for a bearish calendar spread i would use puts. Die kalender spread.

The Dual Calendar Spread (A Strategy for a Trading Range Market) (1106

Calendar spreads allow traders to construct a trade that minimizes the effects of time. The complex options trading strategy, known as the put calendar spread, is a type of calendar spread that seizes opportunities from time. A long calendar spread with puts is created by. To profit from a directional stock price move to the strike price of the calendar.

Calendar Put Spread Options Edge

A calendar spread is a long volatility trade so tends to benefit from rising volatility after the trade is placed. The complex options trading strategy, known as the put calendar spread, is a type of calendar spread that seizes opportunities from time. They are most profitable when the. This helps reduce the risk of early assignment. To profit from a.

Long Calendar Spread with Puts Strategy With Example

Die kalender spread strategie besteht aus dem leerverkauf einer put option und dem kauf einer put option mit demselben basispreis. Calendar spreads allow traders to construct a trade that minimizes the effects of time. A calendar spread is a long volatility trade so tends to benefit from rising volatility after the trade is placed. A long calendar spread with puts.

Bearish Put Calendar Spread Option Strategy Guide

A long calendar spread with puts is created by. Generally if trading a bullish spread i would use calls and for a bearish calendar spread i would use puts. Calendar spreads allow traders to construct a trade that minimizes the effects of time. Das verfallsdatum der verkauften put option ist näher als das verfallsdatum der gekauften put option. Die kalender.

Bearish Put Calendar Spread Option Strategy Guide

Die kalender spread strategie besteht aus dem leerverkauf einer put option und dem kauf einer put option mit demselben basispreis. When running a calendar spread with puts, you’re selling and buying a put with the same strike price, but the put you buy will have a later expiration date than the put you sell. A long calendar spread with puts.

Put Calendar Spread Guide [Setup, Entry, Adjustments, Exit]

This helps reduce the risk of early assignment. Die kalender spread strategie besteht aus dem leerverkauf einer put option und dem kauf einer put option mit demselben basispreis. When running a calendar spread with puts, you’re selling and buying a put with the same strike price, but the put you buy will have a later expiration date than the put.

Das verfallsdatum der verkauften put option ist näher als das verfallsdatum der gekauften put option. A long calendar spread with puts is created by. A calendar spread is a long volatility trade so tends to benefit from rising volatility after the trade is placed. To profit from a directional stock price move to the strike price of the calendar spread with limited risk if the market goes in the other direction. This helps reduce the risk of early assignment. When running a calendar spread with puts, you’re selling and buying a put with the same strike price, but the put you buy will have a later expiration date than the put you sell. Generally if trading a bullish spread i would use calls and for a bearish calendar spread i would use puts. Calendar spreads allow traders to construct a trade that minimizes the effects of time. Die kalender spread strategie besteht aus dem leerverkauf einer put option und dem kauf einer put option mit demselben basispreis. The complex options trading strategy, known as the put calendar spread, is a type of calendar spread that seizes opportunities from time. They are most profitable when the.

Das Verfallsdatum Der Verkauften Put Option Ist Näher Als Das Verfallsdatum Der Gekauften Put Option.

A long calendar spread with puts is created by. To profit from a directional stock price move to the strike price of the calendar spread with limited risk if the market goes in the other direction. Calendar spreads allow traders to construct a trade that minimizes the effects of time. A calendar spread is a long volatility trade so tends to benefit from rising volatility after the trade is placed.

When Running A Calendar Spread With Puts, You’re Selling And Buying A Put With The Same Strike Price, But The Put You Buy Will Have A Later Expiration Date Than The Put You Sell.

They are most profitable when the. Die kalender spread strategie besteht aus dem leerverkauf einer put option und dem kauf einer put option mit demselben basispreis. The complex options trading strategy, known as the put calendar spread, is a type of calendar spread that seizes opportunities from time. This helps reduce the risk of early assignment.

![Put Calendar Spread Guide [Setup, Entry, Adjustments, Exit]](https://i2.wp.com/assets-global.website-files.com/5fba23eb8789c3c7fcfb5f31/6019b83133ac2d32ef084fa5_TsbQgZxQ0e-zKJ9h6Fa7azNlnvn0zH-UBlX3l7hriHll2es1fvyFY5N-nOyM1153MJ4wXLNIhH4zanFkJQB0mpqs81lwEBIvqa7IZQRPWXZY1i3J7vV3BpTIL3v5nCyqn-CEbq2U.png)