Calendar Put Spread

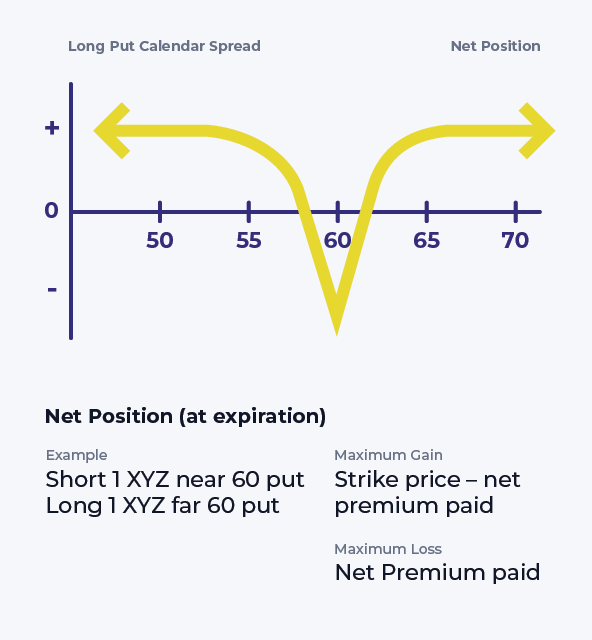

Calendar Put Spread - When running a calendar spread with puts, you’re selling and buying a put with the same strike price, but the put you buy will have a later expiration date than the put you sell. Das verfallsdatum der verkauften put option ist näher als das verfallsdatum der gekauften put option. A calendar spread, also known as a time spread, is an options trading strategy that involves buying and selling two options of the same type (either calls or puts) with the same. Die kalender spread strategie besteht aus dem leerverkauf einer put option und dem kauf einer put option mit demselben basispreis. A calendar spread is a debit spread and as such the maximum that the trader can lose is the amount paid to enter the trade. What is a put calendar? The calendar put spread involves buying and selling put options with different expirations but the same strike price.

Long Calendar Spread with Puts Strategy With Example

The calendar put spread involves buying and selling put options with different expirations but the same strike price. When running a calendar spread with puts, you’re selling and buying a put with the same strike price, but the put you buy will have a later expiration date than the put you sell. Das verfallsdatum der verkauften put option ist näher.

Long Put Calendar Spread (Put Horizontal) Options Strategy

Die kalender spread strategie besteht aus dem leerverkauf einer put option und dem kauf einer put option mit demselben basispreis. A calendar spread, also known as a time spread, is an options trading strategy that involves buying and selling two options of the same type (either calls or puts) with the same. When running a calendar spread with puts, you’re.

Options Trading Made Easy Ratio Put Calendar Spread

What is a put calendar? A calendar spread, also known as a time spread, is an options trading strategy that involves buying and selling two options of the same type (either calls or puts) with the same. Das verfallsdatum der verkauften put option ist näher als das verfallsdatum der gekauften put option. When running a calendar spread with puts, you’re.

Bearish Put Calendar Spread Option Strategy Guide

When running a calendar spread with puts, you’re selling and buying a put with the same strike price, but the put you buy will have a later expiration date than the put you sell. The calendar put spread involves buying and selling put options with different expirations but the same strike price. What is a put calendar? Das verfallsdatum der.

Calendar Spread Options Trading Strategy In Python

The calendar put spread involves buying and selling put options with different expirations but the same strike price. Das verfallsdatum der verkauften put option ist näher als das verfallsdatum der gekauften put option. A calendar spread, also known as a time spread, is an options trading strategy that involves buying and selling two options of the same type (either calls.

How to Trade Options Calendar Spreads (Visuals and Examples)

The calendar put spread involves buying and selling put options with different expirations but the same strike price. A calendar spread, also known as a time spread, is an options trading strategy that involves buying and selling two options of the same type (either calls or puts) with the same. What is a put calendar? Die kalender spread strategie besteht.

Put Calendar Spread Guide [Setup, Entry, Adjustments, Exit]

What is a put calendar? Das verfallsdatum der verkauften put option ist näher als das verfallsdatum der gekauften put option. A calendar spread, also known as a time spread, is an options trading strategy that involves buying and selling two options of the same type (either calls or puts) with the same. A calendar spread is a debit spread and.

Bearish Put Calendar Spread Option Strategy Guide

What is a put calendar? Das verfallsdatum der verkauften put option ist näher als das verfallsdatum der gekauften put option. When running a calendar spread with puts, you’re selling and buying a put with the same strike price, but the put you buy will have a later expiration date than the put you sell. A calendar spread, also known as.

Calendar Put Spread Options Edge

The calendar put spread involves buying and selling put options with different expirations but the same strike price. What is a put calendar? When running a calendar spread with puts, you’re selling and buying a put with the same strike price, but the put you buy will have a later expiration date than the put you sell. A calendar spread,.

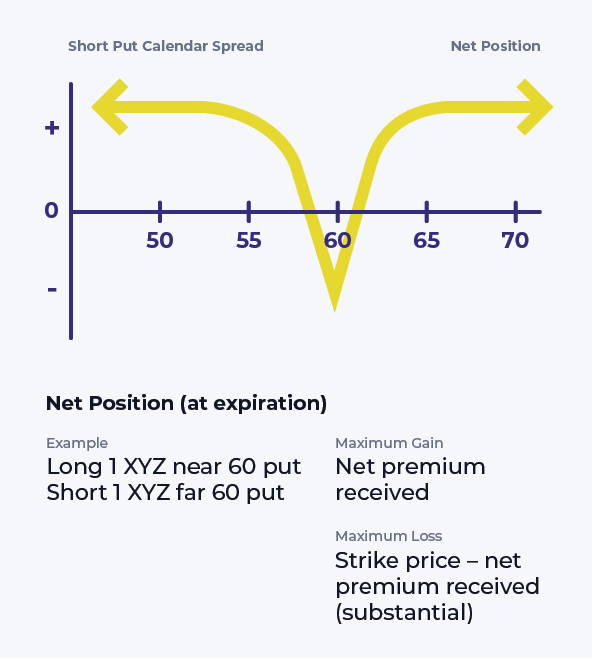

Short Put Calendar Spread Options Strategy

What is a put calendar? The calendar put spread involves buying and selling put options with different expirations but the same strike price. When running a calendar spread with puts, you’re selling and buying a put with the same strike price, but the put you buy will have a later expiration date than the put you sell. A calendar spread.

The calendar put spread involves buying and selling put options with different expirations but the same strike price. Das verfallsdatum der verkauften put option ist näher als das verfallsdatum der gekauften put option. When running a calendar spread with puts, you’re selling and buying a put with the same strike price, but the put you buy will have a later expiration date than the put you sell. Die kalender spread strategie besteht aus dem leerverkauf einer put option und dem kauf einer put option mit demselben basispreis. What is a put calendar? A calendar spread is a debit spread and as such the maximum that the trader can lose is the amount paid to enter the trade. A calendar spread, also known as a time spread, is an options trading strategy that involves buying and selling two options of the same type (either calls or puts) with the same.

When Running A Calendar Spread With Puts, You’re Selling And Buying A Put With The Same Strike Price, But The Put You Buy Will Have A Later Expiration Date Than The Put You Sell.

Das verfallsdatum der verkauften put option ist näher als das verfallsdatum der gekauften put option. A calendar spread, also known as a time spread, is an options trading strategy that involves buying and selling two options of the same type (either calls or puts) with the same. Die kalender spread strategie besteht aus dem leerverkauf einer put option und dem kauf einer put option mit demselben basispreis. The calendar put spread involves buying and selling put options with different expirations but the same strike price.

A Calendar Spread Is A Debit Spread And As Such The Maximum That The Trader Can Lose Is The Amount Paid To Enter The Trade.

What is a put calendar?

![Put Calendar Spread Guide [Setup, Entry, Adjustments, Exit]](https://i2.wp.com/assets-global.website-files.com/5fba23eb8789c3c7fcfb5f31/6019b83133ac2d32ef084fa5_TsbQgZxQ0e-zKJ9h6Fa7azNlnvn0zH-UBlX3l7hriHll2es1fvyFY5N-nOyM1153MJ4wXLNIhH4zanFkJQB0mpqs81lwEBIvqa7IZQRPWXZY1i3J7vV3BpTIL3v5nCyqn-CEbq2U.png)